Budget 2020 ushers in a new era of R&D investment

Thrust into the spotlight a couple of short a long times before the Budget and with a disease pandemic running wild, the new Chancellor, Rishi Sunak, unveiled a budget generally focused on COVID-19 - yet with a couple of welcome declarations for UK organizations.

Similarly, as with the news headlines, coronavirus dominated the current year's Budget discourse. There were immediate shots in the arm announced by the Treasury as government credits to relieve coronavirus business interruption, and - for those with under 250 representatives - refunds of statutory debilitated pay costs as long as 14 days.

Be that as it may, Sunak's center wasn't limited entirely to the near-term worries around COVID-19. There were plans for the UK's economy and infrastructure beyond this crisis alone.

RDEC rate increased to 13%

The new Chancellor reiterated this government intends to increase public R&D investment to £22 billion per year by 2024-25. According to March Budget documents, this investment will take "direct support for R&D to 0.8% of GDP", setting the UK among the top quarter of OECD countries.

This is good information. As usual, however, the devil is in the detail. The overall increase in R&D investment is gladly received, yet we won't have a clue about the precise details of how this £22bn will be spent until the results of the comprehensive spending review are published.

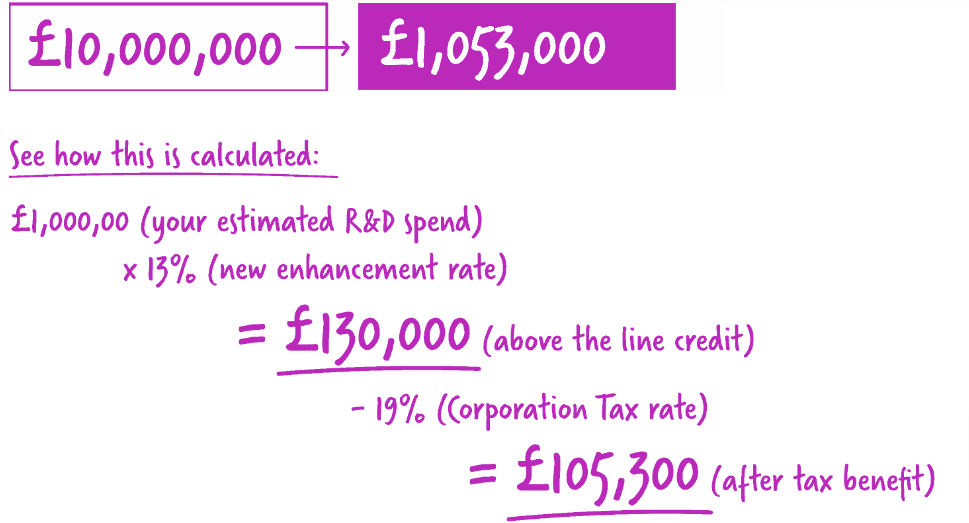

What we do be aware of, however, and this one was mentioned in the Conservative political race proclamation, is that the RDEC rate will be increased from 12% to 13% from 1 April 2020. The expense of this being counterbalanced by reducing as far as possible on Entrepreneurs' Relief gains from £10m to £1m qualified for relief.

Not exactly a 1% increase

The 1% increase in the RDEC rate is, of course, not precisely 1%. RDEC is taxable, so organizations asserting won't see every penny of that increase. Starting around 1 April 2020, the R&D tax credit rate for RDEC will be worth up to 11p for every £1 spent on qualifying expenditures.

RDEC is the large organization's motivator. Nearly 5,000 major organizations claimed relief last year and they stand to guarantee the largest part once more. However, we should not forget that certain SMEs use RDEC, as well. Grant-funded SMEs, among others, can utilize RDEC, and just shy of 4,000 SMEs claimed RDEC in 2018.

Yet, while the RDEC increase is good and will not go entirely too large organizations, Sunak is nonetheless at real fault for the very phonetic skillful deception that Chancellors before him have used, lumping the SME tax credit and RDEC into a similar category.

Sunak boldly stated that the increased RDEC rate will add up to a £2,400 increase "on a regular R&D guarantee". Yet, RDEC isn't the "average R&D guarantee". In true terms, an increase in RDEC rate just advantages 10% of petitioners of R&D tax impetuses.

Over 50,000 British organizations will not get increased R&D funding since they guarantee through the SME R&D impetus, which hasn't seen an increase this time or starting around 2015. Is this cash being targeted fairly and at the right organizations?

For what reason is the government targeting enormous organizations?

The purpose of the R&D tax motivation is to animate private sector investment in advancement. Clear from the Chancellor's discourse increasing this investment in advancement is an outright priority.

Enormous organizations spend the most on R&D (£21bn in 2018) and by increasing the RDEC rate, the government will get significant value for its money. Organizations frequently spend the R&D tax credit benefit they receive on funding the following large push in their R&D work.

Any desire for the government to expand the SME tax credit should stand by, however, until Britain's EU exit is signed, sealed, and delivered. The UK is still party to EU Notified State Aid regulations. These regulations limit the generosity of the SME R&D tax credit while RDEC, then again, isn't. Ideally, Budget 2021 will bring good news on this front.

R&D to drive development

There were a couple of more R&D tax credit declarations nestled in the 125-page red book.

Software R&D to expand

The government announced it will counsel on "whether expenditure on data and cloud registering should fit the bill for R&D tax credits". This doesn't add up to an endeavor to change the definition of software R&D.

Instead, it would be an extension of the current expense categories to include expenditure on data and cloud figuring costs. It's a smaller change than it sounds in practice, however, a welcome update makes the expense categories more reflective of modern commerce.

Externally provided workers (EPWs)

One further change not mentioned in the Budget document relates to regulation on workers provided through intermediaries, generally referred to as IR35. These progressions could prevent some expenditures that organizations currently include in their R&D tax credit guarantee for EPWs from qualifying.

From 6 April 2020, there will be changes to the EPWs rules to ensure that organizations can keep on asserting a similar measure of relief for expenditure on research and development.

PAYE/NIC cap delayed until 2021

The introduction of the PAYE/NIC cap on payable credit in the SME R&D tax impetus has been delayed. The cap - which restricts the credit that a misfortune-creating business can receive to multiple times the organization's all-out PAYE and NICs risk for that year - was due to be introduced for the current year.

It has now been formally delayed until 1 April 2021. This is a welcome relief because the government needs to carefully consider the execution of this cap. While maltreatment of SME R&D really must tax credit is stopped, any cap will influence organizations that, for certified reasons, have low or no PAYE/NIC liabilities, similar to start-ups.

Overall, a positive discourse for organizations and R&D

Rishi Sunak - Sajid Javid's understudy until half a month prior - has delivered a discourse that was overall positive for UK R&D, yet constrained by the progressing coronavirus crisis.

It was never going to be a blockbuster budget. Rightly so: the COVID-19 outbreak is a crisis and the Chancellor needed to act in quick support of the UK's public services. However, there were an adequate number of promising signs that R&D (and simultaneously R&D tax credits) will form a prestigious part of this government's monetary agenda pushing ahead.

Eventually, soon, this pandemic will subside. We trust essentially that the government will push through on its responsibilities to R&D, while carefully reviewing the PAYE/NIC cap and ensuring the motivators fairly reward large organizations and SMEs.

0 Comments

please do not enter any spam link in the comment box.