R&D tax credit rates for the SME conspire?

The research and development (R&D) tax credit plot for SMEs offers an advantage of up to 33% - which could be compared to up to 33p for every £1 spent on qualifying expenditure. The specific rate of relief you receive will depend on your Corporation Tax position, and whether you are profit-or misfortune making.

SME R&D tax credits offer an enhanced deduction for your R&D expenditure. Regular qualified R&D costs include staff and subcontractor expenses, materials, and consumables including intensity, light, and power along with certain kinds of software.

R&D tax credit rates for a profitable SME

Your R&D expenditure already regularly attracts tax relief as part of the normal operating expenses of your trade. Your R&D tax credit guarantee then, at that point, permits a further 130% of this qualified R&D expenditure to be deducted while working out the profits of your organization's trade.

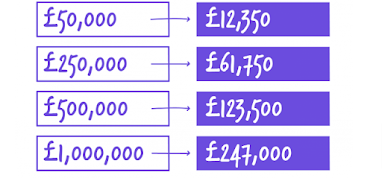

Your accurate return will depend on your passing R&D exercises and expenses. If, for instance, your estimated spend on R&D per year is £500,000, we gauge you could receive up to £123,500 as a tax refund or reduced tax risk. You can perceive how this is calculated here:

R&D tax credit rates for a misfortune-making SME

The SME R&D tax credit conspires likewise permits misfortune-making organizations to guarantee a payable credit. A misfortune-making organization with an estimated R&D spend of £500,000 could guarantee up to £166,750 as a tax credit. You can perceive how this is calculated here:

Even though it appears, at first look, that a misfortune-making SME receives a larger advantage, this isn't true. Assuming you are profit-production, you will have already reduced your taxable profits by the R&D expenditure under normal Corporation Tax rules. The R&D tax credit is in addition to this underlying reduction.

Your definite return will depend on your R&D qualifying expenses and exercises that our expert group identifies. Ensuring you have captured the full degree of your R&D will deliver the greatest incentive for your business and give you true serenity nothing has been missed

0 Comments

please do not enter any spam link in the comment box.